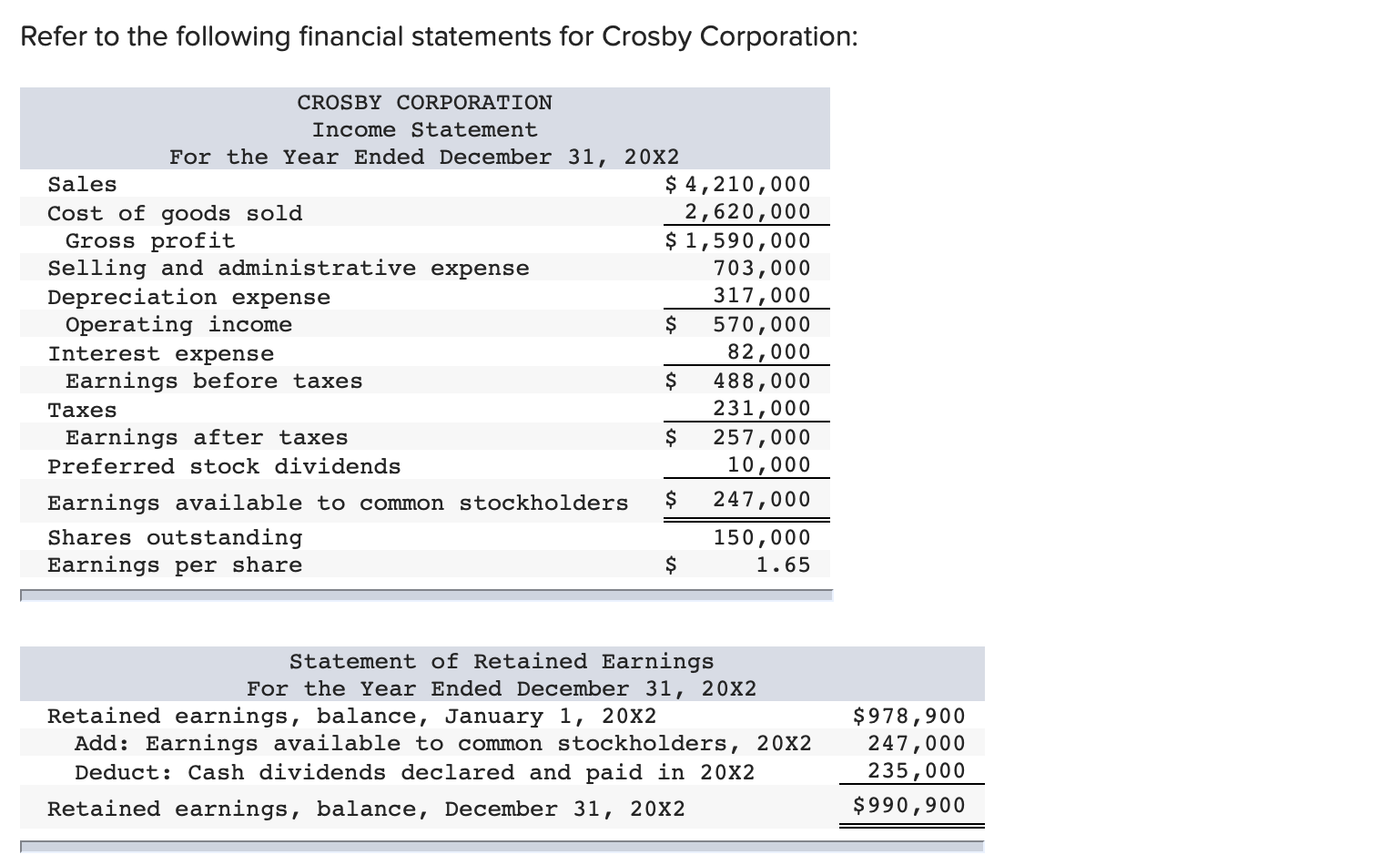

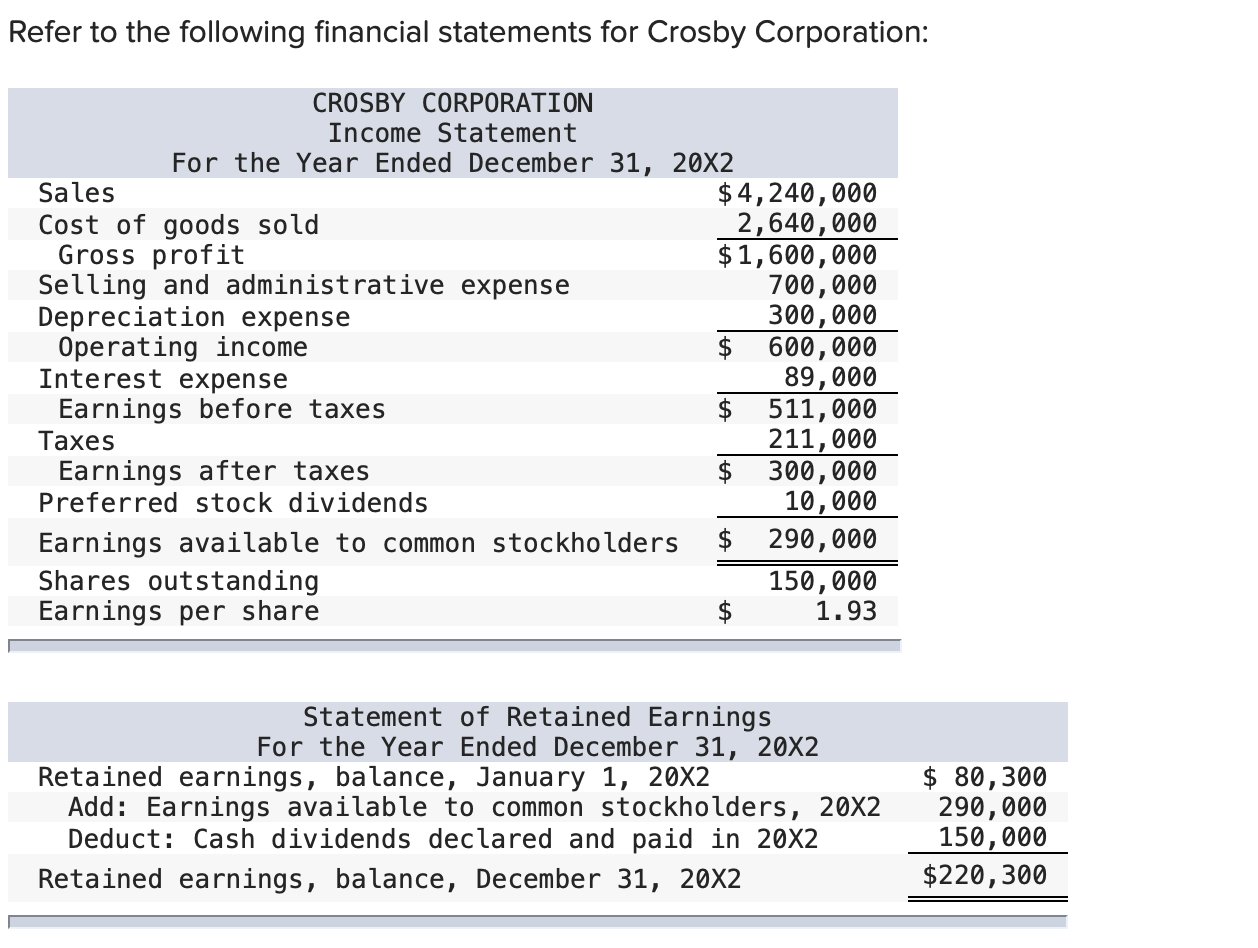

finance Refer to the following financial statements for Crosby Corporation: If the market value of a share of common stock is 3.3 times book value for 20X1, what is the firm’s P/E ratio for 20X2? accounting Crosby Company has provided the following comparative information:

That ’70s Show – Texas Monthly

VIDEO ANSWER: We will find the answers to the question here. Let’s get started with it. The statement of cash flows is asked about here. It’s necessary to follow some steps when we deal with this. Let’s take a closer look at these steps over here.

Source Image: chegg.com

Download Image

Refer to the following financial statements for Crosby Corporation: Compute the book value per common share for both 20X1 and 20X2 for the Crosby Corporation Social Science Economics Finance Question

Source Image: chegg.com

Download Image

Pre-budget | Citizens for Public Justice Refer to the following financial statements for Crosby Corporation: a. Prepare a statement of cash flows for the Crosby Corporation: (Amounts to be deducted should be indicated with a minus sign.) b. Compute the book value per common share for both 2010 and 2011 for the Crosby Corporation. (Round your answers to 2 decimals places.) c.

Source Image: pubs.acs.org

Download Image

Refer To The Following Financial Statements For Crosby Corporation

Refer to the following financial statements for Crosby Corporation: a. Prepare a statement of cash flows for the Crosby Corporation: (Amounts to be deducted should be indicated with a minus sign.) b. Compute the book value per common share for both 2010 and 2011 for the Crosby Corporation. (Round your answers to 2 decimals places.) c. Question: Refer to the following financial statements for Crosby Corporation: CROSBY CORPORATION Income Statement 4.5 For the Year Ended December 31, 20×2 $ 3,650,000 2,230,000 $1,420,000 654,000 273,000 $ 493,000 85,300 $ 407,700 186,000 $ 221,700 10,000 points Sales Cost of goods sold Gross profit Selling and administrative expense Depreciatio

Reimagining Hair Science: A New Approach to Classify Curly Hair Phenotypes via New Quantitative Geometric and Structural Mechanical Parameters | Accounts of Chemical Research

Refer to the following financial statements for Crosby Corporation: Prepare a statement of cash flows for the Crosby Corporation using the general procedures indicated in the table. Refer to the following financial statements for Crosby Corporation: Has the buildup in plant and equipment been financed in a satisfactory manner? Briefly discuss. Is ‘The Simpsons’ Good Again? A Superfan Roundtable | Cracked.com

Source Image: cracked.com

Download Image

Barry McGrath – 🟣 Personal Development Coach – Barry McGrath Coaching | LinkedIn Refer to the following financial statements for Crosby Corporation: Prepare a statement of cash flows for the Crosby Corporation using the general procedures indicated in the table. Refer to the following financial statements for Crosby Corporation: Has the buildup in plant and equipment been financed in a satisfactory manner? Briefly discuss.

Source Image: uk.linkedin.com

Download Image

That ’70s Show – Texas Monthly finance Refer to the following financial statements for Crosby Corporation: If the market value of a share of common stock is 3.3 times book value for 20X1, what is the firm’s P/E ratio for 20X2? accounting Crosby Company has provided the following comparative information:

Source Image: texasmonthly.com

Download Image

Pre-budget | Citizens for Public Justice Refer to the following financial statements for Crosby Corporation: Compute the book value per common share for both 20X1 and 20X2 for the Crosby Corporation Social Science Economics Finance Question

Source Image: cpj.ca

Download Image

How to make money on Pinterest without followers | by Jenn Leach | Jan, 2024 | Medium Answer & Explanation Solved by verified expert Rated Helpful Answered by gleineobidos a. Statement of Cash Flows for Crosby Corporation for the Year Ended December 31, 20X2: Cash flows from operating activities:

Source Image: medium.com

Download Image

CStore Decisions September 2023 by WTWH Media LLC – Issuu Refer to the following financial statements for Crosby Corporation: a. Prepare a statement of cash flows for the Crosby Corporation: (Amounts to be deducted should be indicated with a minus sign.) b. Compute the book value per common share for both 2010 and 2011 for the Crosby Corporation. (Round your answers to 2 decimals places.) c.

Source Image: issuu.com

Download Image

Major questions loom for the Raiders as Pierce and Telesco take charge | National Sports | joplinglobe.com Question: Refer to the following financial statements for Crosby Corporation: CROSBY CORPORATION Income Statement 4.5 For the Year Ended December 31, 20×2 $ 3,650,000 2,230,000 $1,420,000 654,000 273,000 $ 493,000 85,300 $ 407,700 186,000 $ 221,700 10,000 points Sales Cost of goods sold Gross profit Selling and administrative expense Depreciatio

Source Image: joplinglobe.com

Download Image

Barry McGrath – 🟣 Personal Development Coach – Barry McGrath Coaching | LinkedIn

Major questions loom for the Raiders as Pierce and Telesco take charge | National Sports | joplinglobe.com VIDEO ANSWER: We will find the answers to the question here. Let’s get started with it. The statement of cash flows is asked about here. It’s necessary to follow some steps when we deal with this. Let’s take a closer look at these steps over here.

Pre-budget | Citizens for Public Justice CStore Decisions September 2023 by WTWH Media LLC – Issuu Answer & Explanation Solved by verified expert Rated Helpful Answered by gleineobidos a. Statement of Cash Flows for Crosby Corporation for the Year Ended December 31, 20X2: Cash flows from operating activities: